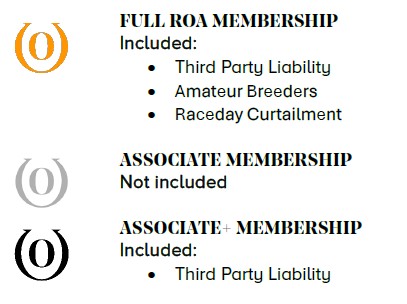

Insurance Schemes

THIRD PARTY LIABILITY INSURANCE

- All ROA members receive automatic third party liability insurance cover (up to a limit of liability of £10 million) against potential damages if their racehorse causes damage or injury. It would be difficult to find a comparable policy for less than the cost of an ROA membership.

- The ROA introduced this scheme as owners are currently vulnerable to claims even when their horse is in someone else’s possession.

- Tragic accidents have left many owners concerned about the risks of a claim – potentially running into millions of pounds – being brought against them by a third party for which they have inadequate protection.

- The law may define a racehorse’s owner as any individual who has a financial interest in that horse, so all members of a partnership or syndicate should be mindful of their potential exposure to that risk.

- In the case of managed syndicate ownership it is important to have Third Party Liability insurance in the name of the syndicate, so all syndicate members have the benefit of cover should they each be found liable in law for their proportion of a multi-million pound damages award.

- Legal precedent has not yet been established as to how racehorse ownership amongst syndicate members is regarded and apportioned in UK Law, but the ROA membership Third Party Liability scheme would respond for a ROA member who is part of a syndicate that is not directly insured itself for Third Party Liability; for their individual proportion of the amount awarded in an action where the syndicate is found to be legally liable for damage.

- The ROA members’ third party liability insurance scheme applies to horses in training, horses being prepared to go into training and horses temporarily out of training. It has now been extended to include Amateur Breeders - find out more here.

- Terms and conditions apply.

|

MASTER POLICY WORDING:

|

MEMBERS WORDING:

|

PRODUCT INFORMATION DOCUMENT

|

Further Reading:

Information for Permit Holders

Please note that the ROA members' Third Party Liability Insurance Scheme does not provide primary cover, the type of which is required by permit holders, licensed trainers and ARO owners who train their own horses.

RACEDAY CURTAILMENT SCHEME

The ROA Raceday Curtailment Scheme, will provide a payment of £100 to any members who own at least 51% of a horse that had been due to run at a meeting that is abandoned after the first race has taken place and the racecourse in question is not paying a compensation payment or that payment is below £250.

The scheme is now solely supported by the ROA in 2024 and beyond.

On average, around 200 horses and their owners are affected each year when a race meeting is curtailed after racing has started. This scheme has been introduced with the aim of reducing the financial blow to an owner who is left disappointed that their horse is unable to race but still has incurred transport costs, both for the horse and, often, themselves.

Members do NOT need to apply for this Scheme. As long as the affected owner's ROA membership is up to date the payment will be made automatically.

Terms and Conditions

- Available exclusively to ROA members as a benefit of the full membership tier.

- The ROA will pay £100 to the owner of a horse when it is unable to run as a result of the meeting being abandoned for the day after at least the first race has been run.

- The payment will be made where the racecourse in question is not paying a compensation payment or that payment is below £250.

- The payment will be made to an ROA member who owns at least 51% of an eligible horse. Alternatively, if in total, at least 51% of a horse is owned by ROA members, the payment will be made to the ROA member with the largest recorded share of ownership or to the first nominated partner.

- The payment will only apply to declared runners and is not applicable to any published non-runners at the time of abandonment.

- The scheme is confined to race meetings in the United Kingdom.

- The entirety of the remainder of the meeting needs to be abandoned in order for the compensation scheme to be activated.

COMPENSATION SCHEME (ROCS)

A partnership between the Racehorse Owners Association and the renowned bloodstock insurance broker, Lycetts, enables ROA members to take advantage of the cover provided by ROCS.

This insurance policy is designed specifically for horses in training and is ground-breaking in the cover that it gives.

The Racehorse Owners Compensation Scheme (ROCS) provides:

- Financial compensation for the owner of a racehorse that is injured, either temporarily or permanently.

- The costs of treating the horse at a top veterinary clinic.

- The value of the horse if it dies.

View our full ROCs brochure as a PDF here:

For further information and a full description of the insurance cover, please contact Lycetts' offices in Newmarket or Marlborough.

| Lycetts The Coach House, 168 High Street, Newmarket, Suffolk CB8 9AQ Tel: 01638 676700 Fax: 01638 664700 [email protected] |

Lycetts 1 Stables Court, The Parade, Marlborough, Wiltshire SN8 1NP Tel: 01672 512512 Fax: 01672 516660 [email protected] |

AMATEUR BREEDERS

The ROA’s third party liability scheme for members has been enhanced to include cover for owners of Thoroughbred broodmares and youngstock. Cover will apply to owners of foals, weanlings, yearlings or stores being kept solely for the purposes of rearing within the insured definition under your members third party liability scheme.

The cover has been tailored specifically for the ROA by Brown & Brown for the racehorse owner who is also an amateur breeder. It will not apply where the ownership of breeding stock is professional or a business and will apply only where there is no more specific insurance in existence (as the current scheme terms).

The full definition is as follows:

Broodmare(s)/ Youngstock Means a Thoroughbred and/or Purebred Arabian (PA) broodmare, verifiable foster mare or youngstock (Thoroughbred and/or Purebred Arabian (PA) foals, weanlings, yearlings or stores) owned by a Member who is an Amateur Breeder, registered with Weatherbys or the Arabian Racing Organisation (ARO) and kept solely for the purposes of breeding or rearing. This includes whilst being prepared for the sales or a racing career. If a mare is being rested as a result of a late covering for instance, but the intention is to return to breeding, then cover remains effective. As soon as a broodmare is retired fully from being used for breeding purposes cover ceases.

We have a simple Question and Answer sheet for more information: