Weatherbys Bank update

In August 2024, the ROA through owners’ direct feedback, identified, highlighted and raised important concerns about the changes to the onboarding process at Weatherbys Racing Bank.

These concerns reflected the need to balance evolving regulatory expectations with a smooth joining journey for clients – particularly for clubs, partnerships and multi-owner syndicates. Acting on behalf of owners we contacted the relevant parties at Weatherbys Bank, and also highlighted the concerns with the BHA and NTF. The challenge was set to find a suitable and compliant solution which supported and enhanced this requirement on behalf of owners.

It is therefore pleasing to update that there have been various productive discussions across the groups, including direct examples of the challenges being faced, and highlighted the key audiences concerns directly as part of a thorough consultation process with Weatherbys Bank.

Having reviewed the proposed incoming changes, which streamline the applications, alongside other customer audiences, Weatherbys Racing Bank have confirmed the following:

“Following feedback from Racing bodies, industry and clients, Weatherbys is in the final stages of changing and simplifying its multi-owner onboarding process. We are currently engaging with industry bodies for feedback and anticipate a go-live of the new simplified process in July 2025.”

The ROA have also been advised that this will then be followed with further enhancements to the Bank's digital onboarding functionality during 2026. This is all very much welcomed to ease and support the owners administrative processes. For further information or to discuss these matters please contact [email protected].

Details of simplified multi-owner onboarding:

We have listened to industry and client feedback and, as a result, Weatherbys Racing Bank hassimplified its onboarding process for Multi Owner Accounts, making it easier and clearer for racingclubs, syndicates and partnerships to open accounts. Our improvements respond directly to industryand client feedback, reducing complexity while ensuring regulatory compliance.

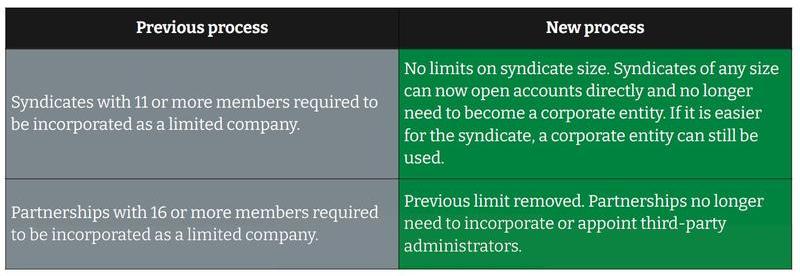

What has changed?

Clear and simplified forms

Clear and simplified forms

Each type of multi-owner arrangement now has its own dedicated application form:

- Unincorporated racing clubs – completed by the club manager

- Incorporated racing clubs – completed by the corporate club

- Unincorporated syndicates – completed by the individual syndicator

- Incorporated syndicates – completed by the corporate syndicator

- Partnerships – completed by the nominated lead partner representative

Reduced documentation

Under the new simplified process, we ask each Member/Partner to complete just a brief one-page ‘Syndicate’ or ‘Partner’ member form. This captures the core information needed for regulatory purposes in a straightforward and user-friendly way

- Name and address

- Date of birth

- Nationality

- Telephone number and email address

- Employer and occupation

Please note: unincorporated racing clubs are exempt – only the club manager needs to complete the application.

Benefits of the new simplified process

Additional Information

Incorporated clubs and syndicate management companies. In line with UK anti-money laundering standards, when onboarding companies we will need to include the entity’s beneficial owners in the process where ownership exceeds 25 per cent in the UK or 10 percent overseas, along with any signing directors. For syndicates managed by incorporated syndicate management companies, the Bank will onboard all members with a 10 per cent or greater holding.

Ongoing due diligence

To meet our anti-money laundering obligations, Weatherbys Racing Bank is required to carry out ongoing due diligence activity. As part of this, we may contact existing syndicate members from time to time to refresh our due diligence information. While we will make this as easy as possible, completion is a mandatory UK regulatory requirement.

As part of the current ongoing due diligence review, during the remainder of 2025 and into 2026 we may contact some clients to refresh and confirm our current details are up to date. We will keep this process light, using electronic verification wherever we can to minimise any disruption. This is a mandatory part of UK banking regulations. If we need anything from you, we will let you know what will be needed and guide you through it step by step.

Enhanced due diligence

We may ask some clients and members to complete additional enhanced due diligence checks if deemed necessary. We will guide you through this process if and when it applies.

Investing in digital services

Weatherbys is investing significantly in the digitalisation of its platforms to support the racing industry. Over the next 12 months, we will be launching a new digital onboarding platform and our aim is to make the onboarding process quicker and paper free.

Feedback and continued engagement

We are here to help throughout and will continue to engage with industry bodies and clients. We welcome your ongoing feedback and engagement, while remaining dedicated to enhancing our services and simplifying your racing banking experience. Should you have any queries, please do not hesitate to speak to your relationship manager or call us on +44 (0) 1933 543 543.